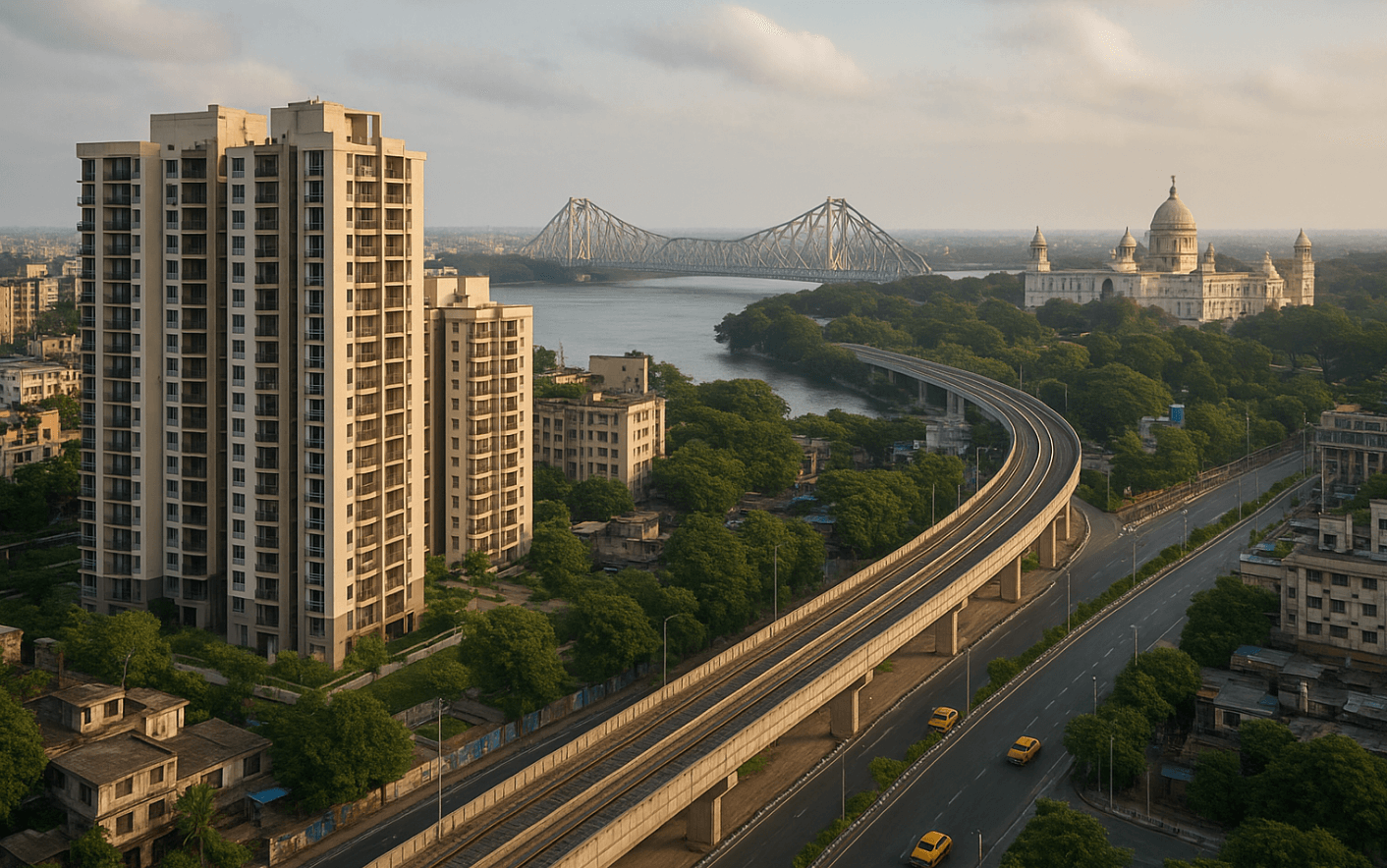

In a significant commercial real estate transaction in eastern India, a leading national developer has agreed to transfer ownership of its Kolkata IT/ITeS special economic zone (SEZ) and nearly 18 acres of adjacent land to a regional real estate firm for around ₹670 crore. The deal underscores evolving investment dynamics in India’s tier-2 urban office markets and carries implications for Kolkata’s long-term urban growth and workspace ecosystem.

The assets include an operational technology park with existing leasable area and a large freehold land parcel, both of which are poised to strengthen the buyer’s development pipeline in the city. The deal, structured through separate agreements for the SEZ business and the vacant land, is expected to conclude over the coming months after regulatory clearances and customary conditions are met. Real estate analysts describe the transaction as part of a broader repositioning trend by developers across India. Faced with shifting demand and capital allocation priorities, major developers are divesting non-core commercial holdings to focus on higher-growth segments such as residential and integrated townships. “Monetising legacy commercial assets is now a common strategic lever to balance portfolios and free up capital,” says a senior investment strategist. For Kolkata, the transfer of an established SEZ asset holds layered implications. On one hand, it represents continued investor confidence in a city that has historically trailed behind metros like Bengaluru and Hyderabad in office absorption. On the other, the change in ownership could unlock fresh development momentum at a time when regional office markets are grappling with cyclical challenges and changing occupier preferences post-pandemic.

The SEZ business being divested contributed a modest slice of the seller’s overall revenue in the most recent fiscal year, reflecting its relative scale within a larger national portfolio. Leasing activity within the space has historically been anchored by a mix of IT and technology-enabled services tenants, whose demand profiles remain influenced by broader tech sector trends and hybrid work practices. Urban planners and property experts note that large tech parks and SEZs play a crucial role in shaping employment clusters and supporting knowledge-economy jobs outside primary hubs. “These campuses anchor local labour markets and stimulate demand for supporting services — from transit to hospitality — that contribute to citywide sustainability and equitable job distribution,” explains an urban development consultant. The adjacent 17.75-acre land parcel embedded in the deal presents potential for future mixed-use or commercial development, subject to planning approvals and market conditions. Its integration into the buyer’s landbank could offer opportunities for phased projects that align with inclusive urban growth objectives, enhancing both employment density and local amenities.

From an economic perspective, this sale aligns with transactional activity seen in Kolkata’s commercial property segment over recent years, where established office assets have traded between institutional and regional developers. Industry observers highlight that while Kolkata’s housing market has seen some cooling, commercial land and office asset deals reflect sustained strategic interest in long-term urban infrastructure. For residents and city stakeholders, the evolving ownership of major office and development sites underscores the need for coordinated urban planning that supports climate-resilient infrastructure, transit-oriented growth and equitable access to opportunities. As the transaction advances to completion, monitoring leasing patterns and development proposals will be key to understanding its full impact on Kolkata’s built environment.

Also Read: Pune Infrastructure Push Focuses on Key Rail Bridge

Kolkata Real Estate Sees Major IT Asset Ownership Shift