India’s residential real estate growth story is undergoing a quiet but consequential geographic shift. While Mumbai and Delhi continue to command attention for record transaction values, long-term data now points to a different set of cities delivering superior investment outcomes. Among them, Bhubaneswar has emerged as a standout, reflecting how mid-sized cities are reshaping the country’s housing economics.

An analysis of India’s official housing price index over the past decade shows that residential property values in Bhubaneswar have risen at a pace unmatched by most metropolitan markets. The Odisha capital has recorded cumulative returns well above those seen in several tier-I cities, underscoring how consistent growth, rather than scale alone, is driving wealth creation in housing. Urban economists attribute this performance to a combination of disciplined city planning, lower entry prices, and steady end-user demand. Unlike larger metros burdened by congestion, regulatory complexity, and affordability constraints, Bhubaneswar has expanded through planned residential zones supported by institutional employment, education hubs, and public sector investment. This has helped sustain price appreciation without the volatility often seen in overheated markets. The trend extends beyond a single city. Data across multiple time horizons indicates that several non-metro and peripheral urban centres including parts of Gujarat and the National Capital Region have delivered stronger medium- and long-term returns than established urban cores. Over five- and three-year periods, these markets have continued to outperform, suggesting that investor confidence is shifting structurally rather than opportunistically.

This rebalancing coincides with the Union Budget 2026, which reinforced infrastructure-led growth as a central economic strategy. Expanded investment in highways, logistics corridors, and urban infrastructure is expected to improve connectivity between employment centres and residential markets, making Tier-2 and Tier-3 cities more viable for long-term settlement. However, the absence of fresh policy support for affordable housing has raised concerns among developers and housing advocates, particularly as construction costs continue to rise. Urban planners note that infrastructure spending alone does not guarantee inclusive growth. Cities benefiting from new capital inflows will need parallel investments in water systems, public transport, and climate resilience to avoid repeating the stress patterns of larger metros. In this context, Bhubaneswar’s relatively moderate density and scope for climate-responsive development offer a strategic advantage. Market analysts also point to evolving employment patterns as a factor. The decentralisation of office demand, growth of regional economic hubs, and expansion of digital infrastructure are weakening the historical link between high-paying jobs and megacities. As a result, housing demand is following opportunity rather than prestige.

For policymakers, the emerging data presents both validation and warning. While India’s real estate ecosystem is diversifying geographically, sustaining this momentum will depend on governance capacity and long-term planning. For investors and homebuyers alike, the message is clear: the next phase of housing value creation may lie not in the country’s most visible cities, but in those building quietly, consistently, and with an eye on livability.

Also Read: Sunteck Realty Signals Confidence in MMR Growth

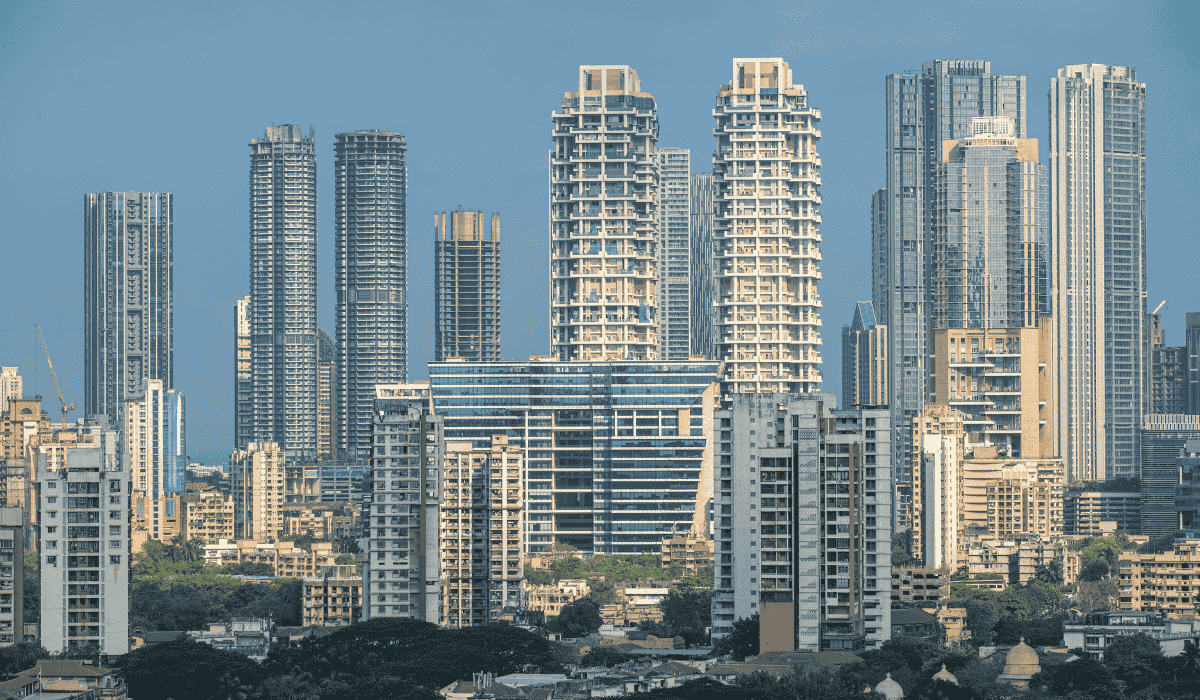

Emerging Cities Redefine India Real Estate Gains