Hyderabad’s residential property market is set to gain renewed momentum as a major public sector lender partners with the city’s leading developers’ body for a large-scale housing exhibition scheduled early next year. The collaboration brings regulated housing supply and formal credit access onto a single platform, a move that reflects the growing emphasis on transparency and buyer confidence in India’s urban housing markets.

The three-day property exhibition, planned at a major convention venue in Hyderabad in February 2026, will feature residential projects exclusively from registered developers whose offerings comply with the Real Estate Regulation Act (RERA). Urban economists say this alignment between institutional finance and regulated housing supply is becoming increasingly critical as cities expand and first-time buyers navigate complex purchasing decisions. Hyderabad has emerged as one of India’s fastest-growing housing markets, driven by steady employment growth in technology, life sciences and global services. However, rising home prices and tighter household budgets have made access to affordable and predictable home finance a central concern. By embedding loan facilitation within a curated property marketplace, the Hyderabad property show aims to reduce uncertainty for buyers while shortening decision cycles. Senior banking officials familiar with the initiative indicate that the lender’s role at the event will focus on preliminary credit assessments and customised loan guidance rather than aggressive sales. This approach mirrors a broader shift within public sector banking towards risk-calibrated housing finance, particularly in high-growth urban centres where speculative activity has previously distorted demand.

From a market perspective, developers see such platforms as a way to re-anchor demand around compliance and delivery capability. With only RERA-approved projects allowed to participate, the exhibition is expected to filter out informal or under-capitalised supply, reinforcing accountability within the local real estate ecosystem. Industry analysts note that this can have longer-term benefits for urban resilience by encouraging better construction standards and financial discipline. The Hyderabad property show also has wider civic implications. Urban planners point out that concentrating buyer activity around vetted projects can indirectly support sustainable development goals. When buyers are steered towards formally approved housing, it improves the likelihood of projects adhering to environmental clearances, infrastructure norms and energy-efficiency guidelines mandated under current regulations. For the city, the event arrives at a time when housing demand is diversifying beyond traditional western corridors into emerging zones supported by new transport and social infrastructure. Access to formal finance will play a decisive role in shaping how inclusive this expansion becomes, particularly for middle-income households.

As Hyderabad continues to balance growth with liveability, collaborations between banks and developer bodies signal a more mature housing market. The real test will lie in whether such platforms translate into safer purchases, timely project delivery and a housing supply aligned with the city’s long-term urban and climate priorities.

Also Read: Hyderabad GCC Expansion Redraws Urban Property Demand

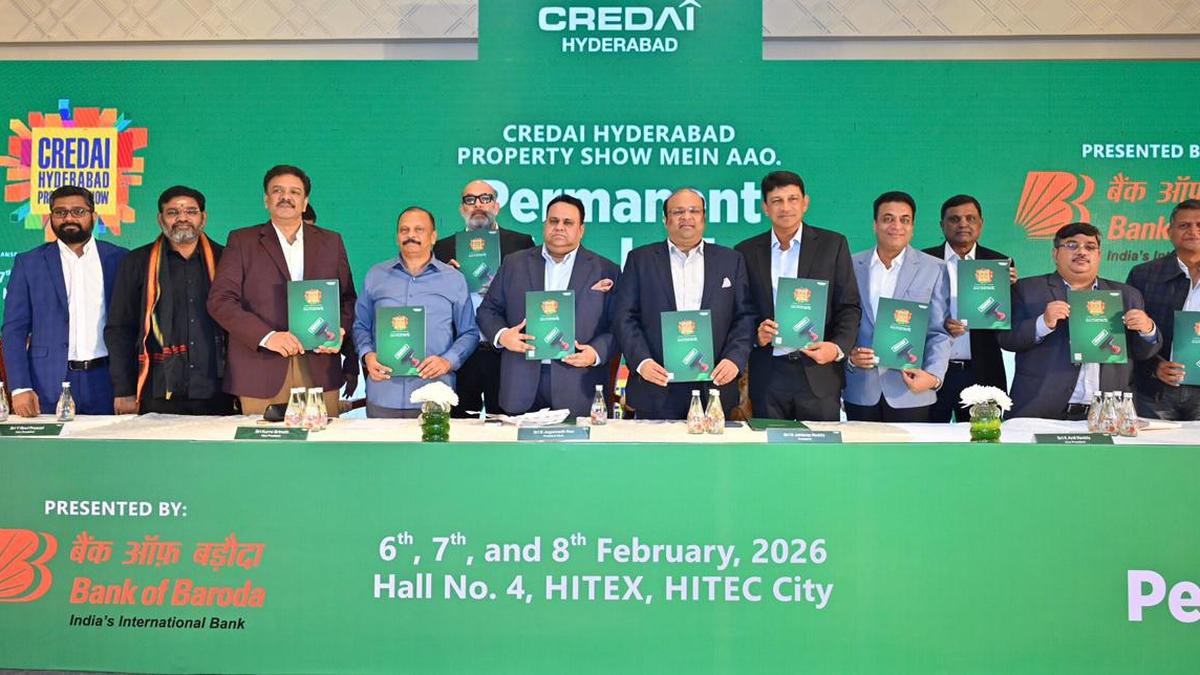

Bank of Baroda Backs Hyderabad Property Show 2026