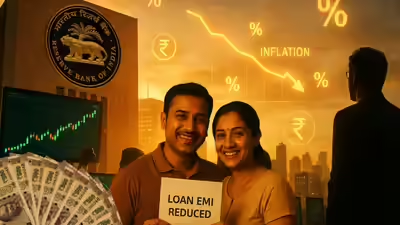

Inflation rarely announces itself to homebuyers, yet its impact on housing finance can be decisive. As price pressures persist across the economy, borrowers particularly those servicing long-term home loans are increasingly exposed to higher monthly outgoes that arrive quietly but compound over time. For India’s expanding urban middle class, this has become a defining affordability challenge.

The mechanism is indirect but predictable. When inflation accelerates, the central bank typically tightens monetary policy to curb demand. Higher benchmark rates raise borrowing costs for banks, which are then transmitted to retail lending products, including housing loans. New borrowers encounter steeper interest rates at entry, while existing borrowers on floating-rate contracts see their repayment schedules recalibrated periodically. Even modest rate changes can have an outsized effect over long tenures. Housing loans are usually structured for 15 to 25 years, meaning interest rate adjustments ripple through thousands of monthly instalments. A shift of one percentage point can add several lakh rupees to the total repayment value of a standard urban home loan, stretching household budgets already under pressure from rising food, fuel and education costs. This sensitivity highlights why inflation matters far beyond headline numbers. From a lender’s perspective, higher rates protect real returns when prices are rising. From a borrower’s standpoint, however, the same adjustment erodes disposable income and reduces financial flexibility. Urban planners and housing economists note that this dynamic can influence buying behaviour, delaying first-time purchases or pushing households towards smaller homes and peripheral locations.

Loan structure plays a critical role in determining exposure. Fixed-rate loans offer payment certainty, shielding borrowers from short-term rate volatility. Floating-rate loans, while often cheaper initially, transfer inflation risk directly to households. The impact is magnified for larger ticket loans common in metro regions, where property prices and therefore loan sizes are significantly higher. The broader urban implication is equally important. Housing affordability is a cornerstone of inclusive and resilient cities. When inflation-driven rate hikes inflate EMIs, they can slow housing demand, disrupt construction cycles, and widen the gap between income growth and home ownership. This is particularly relevant as cities seek to balance private real estate development with affordable housing supply. Financial planners advise borrowers to stress-test their budgets against potential rate increases, rather than relying on current EMI levels. Regularly reviewing loan terms, considering partial prepayments, and evaluating refinancing options can reduce long-term exposure. Digital tools now allow households to simulate repayment scenarios under different interest environments, enabling more informed decision-making.

As inflation remains a structural concern rather than a temporary spike, the real challenge for India’s housing market is preparedness. Home loans will continue to anchor urban aspirations but only those aligned with realistic financial planning will remain sustainable over time.

Also Read: Embassy REIT Strengthens Board With Global Accounting Veteran

India Home Loans Face Hidden Inflation Pressure